While the use of 3D printing for rapid prototyping has been developing since the late 80s and is now extremely common, the industry has also steadily continued its move towards production applications, including low-volume production, mass customization, and serial production. “We’re seeing more and more large-quantity orders and repeat orders,” says Protolabs’ Robin Brockötter. “There’s definitely a trend towards full-scale production.” This is influenced by many and diverse factors, including a preference for more local production amid global supply-chain disruptions (9% of our survey respondents said low susceptibility to supply chain issues is the main reason why they opted for 3D printing over other manufacturing methods) and sustainability concerns.

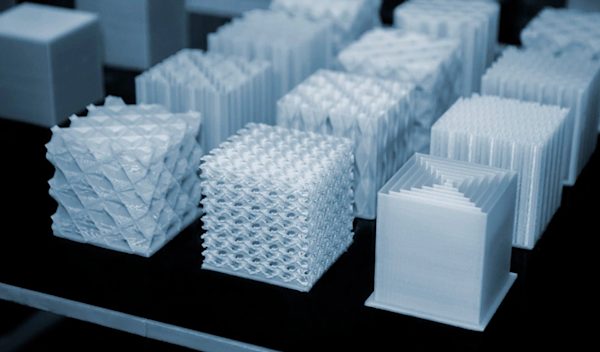

In 2023, 21% of our survey respondents used 3D printing for end-use parts—up from 20% in 2022—and 4% used it for aesthetic parts. When it comes to replacing injection-molding manufacturing with 3D printing processes, it’s all about order volumes: for low-volume production, 3D printing is often the more cost-effective solution, while at higher volumes, injection molding becomes more economical. However, the point where that happens— the ‘sweet spot’ of maximum viable 3D printing order volume—is shifting. “3D printing can now start producing more and more parts before injection molding becomes cheaper,” says Brockötter. Results from our 2024 survey support this. In our 2023 survey, doubts around 3D printing as a choice for “production volume and scale” led 47% of respondents to opt for different manufacturing technologies, but this year that number has dropped to 45%, showing increased confidence in scaling with 3D printing. And throughout the years, our surveys also show a steady growth in production-run volumes: respondents saying they printed more than 10 parts rose from 36% in 2020, to 49% in 2021 and to 76% in 2022. While this figure has stayed the same for 2023, marking stabilization, the percentage of respondents saying they printed more than 1000 parts rose from 4.7% in 2022 to 6.2% in 2023.

Beyond the actual printing process, there are many other aspects that influence the scalability of using 3D printing technologies for production, from software, design, and materials to post-processing and finalizing tasks such as cleaning, secondary finishing, spot removal, stress relief, and inspections. As the 3D printing ecosystem continues to mature, a support system of companies providing many of these services is springing up around 3D printing businesses, simplifying production processes. This in turn will encourage the uptake of these processes. In addition, increasing familiarity with DFAM—the additive design space—will mean engineers and designers will become more proficient at navigating design limitations and opportunities and leveraging new materials.

And many obstacles are becoming less of an issue due to new developments and technologies. One example is post-processing, which can currently present a bottleneck. 27% of respondents to the 2024 survey named “post-processing and finishing requirements” as a reason for choosing other manufacturing methods over 3D printing, and 40% listed “quality and consistency of the final product”. However, as vapor smoothing is becoming prevalent across the industry and surface finishes are being radically improved, postprocessing is becoming less of a hurdle for production-level 3D printing. “Vapor smoothing machines have come a long way in recent years,” says Grant Fisher, supply chain manager at Protolabs, “specifically for vapor smoothing Nylon 12”—the most common material for MJF and SLS parts. “We continue to see a lot of growth in MJF and SLS, and vapor smoothing is a great option for aesthetic and end-use parts.”

Another example is automation of the manufacturing process. For instance, computer-visionsupported systems to help sort finished 3D printed parts can represent significant labor savings and cost efficiency, further pushing the numbers in favor of 3D printing.

Standardization is one key issue that remains, particularly in sectors such as aerospace, automotive and the medical industry. “We do a lot of work with aerospace, particularly in metal printing,” says Protolabs’ Eric Utley, “and the big hurdle that everyone’s dealing with is standardization. Building out that validation and standardization—I personally think it will take a few years to unstick that.” But the will is there and the cogs are moving. “It is a big talking point in the wider industry,” says Utley.

The medical and aerospace sectors are the ones where 3D printing for production will continue to play the biggest role, says Alex Huckstepp. “These are the industries that are willing to spend a lot on high-performance, high-quality, complex custom designs and components. And that was always thought of as where 3D printing in production could make sense. The real production growth is still coming from those two industries. The space-race boom that we’re seeing has definitely been a tailwind for 3D printing.”

There’s another point that’s often overlooked when discussing production-level 3D printing, sometimes to the detriment of embracing its incredible potential: it shouldn’t necessarily be approached as a replacement for existing technologies at all. “I think a lot of people have in their mind that 3D printing is an injection molding competitor—yeah, it’s not,” says DIVE’s Adam Hecht. “It’s an entirely new way of making things. They just don’t compete. There’s some overlap, yes, but ultimately, their careers separate. 3D printing is an entirely new tool. It’s enabling us to solve problems, and ultimately, to make products that previously couldn’t exist. All the low-volume, specialized applications and products where you previously had to tell people, sorry, we can’t make that—we can make them now. It’s just entirely different.”

And one thing that’s going to enable and accelerate this are the specialized materials that are increasingly emerging on the 3D printing market.

For more insights on the 3D printing industry including market data and future trends, download a copy of our 3D Printing Trend Report 2024.